2024 Home Office Deduction Schedule C – Note that the provided schedule is approximate, and changes may occur. Any modifications will be promptly communicated through the Commission’s website. Regular updates regarding the estimated . With respect to the 20% deduction for qualified pass-through income, for 2024, the threshold amount at which the “specified service trade or business” phaseout and the wage (or wage+property) .

2024 Home Office Deduction Schedule C

Source : turbotax.intuit.com

Tax advice for clients who day trade stocks Journal of Accountancy

Source : www.journalofaccountancy.com

World Kidney Day

Source : www.facebook.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

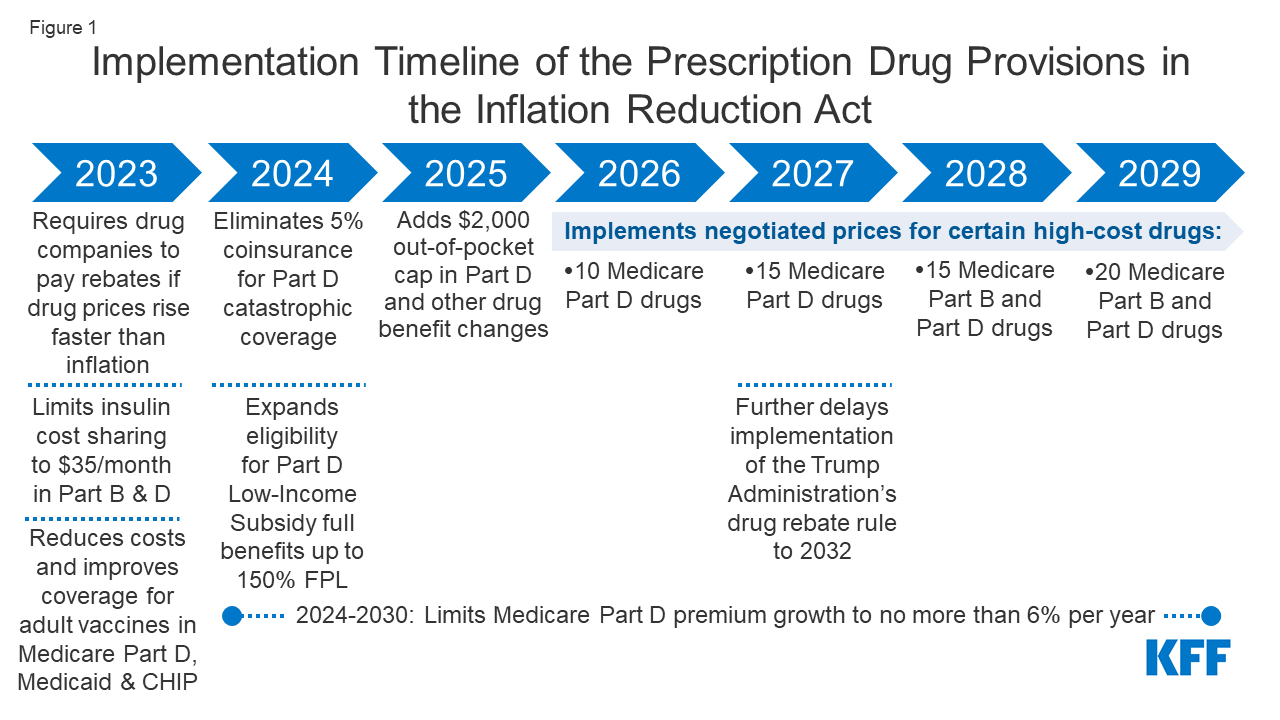

How Will the Prescription Drug Provisions in the Inflation

Source : www.kff.org

Dublin Nissan Bay Area Nissan Dealer Near Hayward, San Leandro

Source : www.dublinnissan.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Recreational Cannabis Businesses

Source : www.nj.gov

Federal Register :: Medicare Program; FY 2024 Inpatient

Source : www.federalregister.gov

2024 Home Office Deduction Schedule C The Home Office Deduction TurboTax Tax Tips & Videos: Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . 2024 Standard Deduction Amounts For 2024, the additional standard deduction amount for the aged or the blind is $1,550. The additional standard deduction amount increases to $1,950 for unmarried .